TAX DEDUCTIONS

TAX DEDUCTIONS

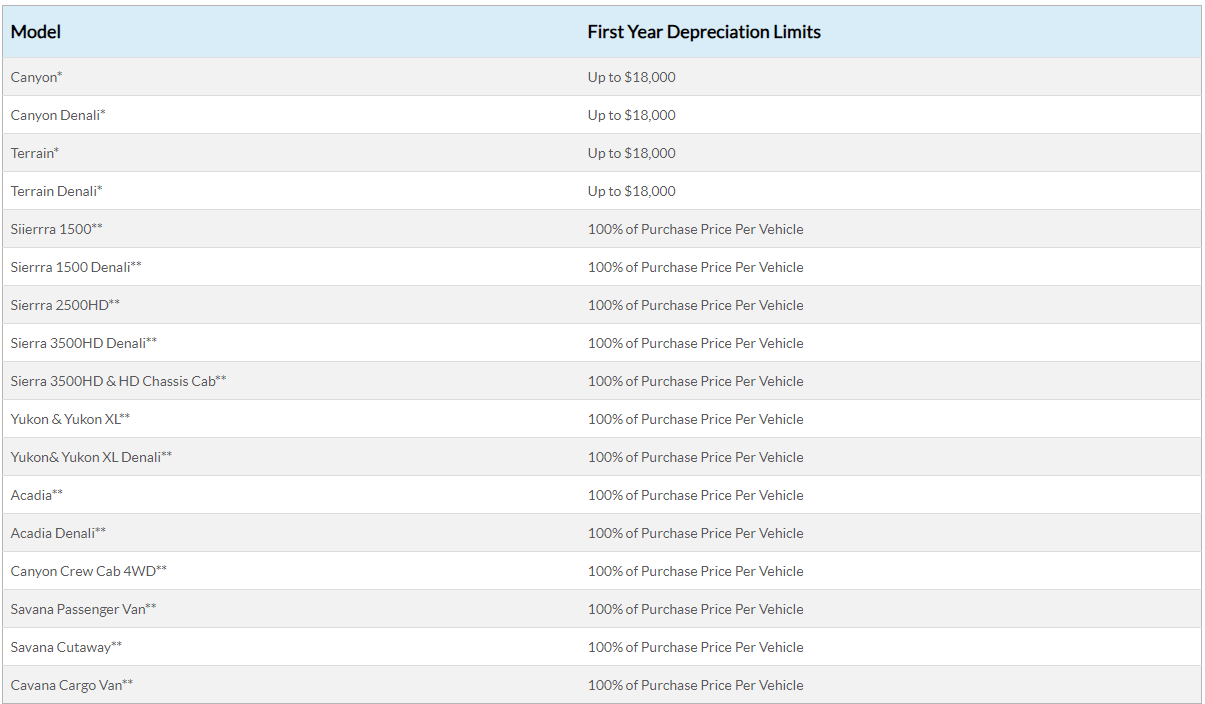

Small businesses may be eligible to claim up to 100% of their vehicle purchase price

You might be able to deduct 100% of the cost of qualifying vehicles used in your business under new depreciation laws! Now is the perfect time to update your fleet of vehicles and lower your business' tax burden.

HOURS OF OPERATION

- Monday9:00 am - 7:00 pm

- Tuesday9:00 am - 7:00 pm

- Wednesday9:00 am - 7:00 pm

- Thursday9:00 am - 7:00 pm

- Friday9:00 am - 7:00 pm

- Saturday9:00 am - 7:00 pm

- Sunday10:00 am - 6:00 pm

*Passenger automobiles, as defined in the IRS Code (Including SUVS, Trucks and crossovers with a GVWR up to 6,000 lbs) and placed in service during 2019 qualify for immediate depreciation deductions of up to $18,000 per vehicle. **Trucks vans and SUVs as defined in the IRS Code with a GVWR over 6,000 lbs and placed in service during 201 qualify for immediate depreciation deductions of up to 100% of the purchase price.

Each individuals tax situation is unique; therefore, please consult your tax professional to confirm vehicle depreciation deduction and tax benefits. For more details visit www.irs.gov.

6,000 POUNDS VEHICLE TAX DEDUCTION: WHAT IS IT?

In accordance with the federal tax code, a vehicle purchasing price that exceeds 6,000 pounds can be deducted up to $25,000 from a taxpayer's tax return. In order to qualify for purchase, the vehicle must weigh over 6,000 pounds, but must not exceed 14,000 pounds. Applicants must be using trucks and SUVs for business purposes.

The program is designed to encourage business owners to invest in new vehicles to support their company's growth.

Section 179 of the federal tax code provides details on the tax deduction. Vehicles must be put into service by December 31 of the tax year to qualify for the deduction. It may be necessary for you to keep a record of your work-related trips with the vehicle, including the purpose of the trip.

IS THERE ANY OTHER GUIDELINE TO QUALIFY?

In order to claim the deduction under Section 179, you must meet several conditions. The SUV or truck weighing over 6,000 pounds must first be purchased with a loan agreement recognized by the IRS or leased. Your business name must also appear on the vehicle title. In other words, if your name appears on the title, you can't claim the deduction.

The deduction may still be available even if you don't use the vehicle for business purposes all the time. You will typically be able to claim a maximum deduction based on how much time you spend driving the SUV or truck for work-related purposes. In the case of a GMC Yukon, for example, if it is used 80 percent for business purposes, the maximum deductible would be $20,000, which is 80 percent of the $25,000 maximum. A deduction will not be available if the vehicle is used less than 50% of the time for business purposes.

Last but not least, the IRS has introduced an upper limit of $1 million for Section 179 deductions. This means that you can make large tax savings if you need to purchase several vehicles to upgrade your fleet or expand your existing one.

BUICK & GMC SUVS OVER 6000 LBS

Here are the vehicles included in our inventory that qualify for the 6,000-pound vehicle tax deduction.

A DEPRECIATION FOR BUICK ENCLAVES

According to estimates, the Buick Enclave will depreciate 54% after 5 years and have a resale value of $22,059 after 5 years.

Enclave is a three-row SUV that can seat up to seven people and weighs over 6,000 pounds. As well as offering plenty of room for passengers, it also boasts over 97 cubic feet of storage with both rear rows folded down. For businesses that frequently transport large items, the Enclave is a great choice. With 310 horsepower, the Enclave's 3.6-liter V-6 engine delivers solid power.

DEPRECIATION OF THE GMC ACADIA

After 5 years, the GMC Acadia is expected to depreciate 50% and may have a resale value of $20,740.

The Acadia is another three-row SUV that can seat six or seven, depending on the second row seats. The Acadia offers plenty of legroom for adult passengers, which makes it a good option for regular transportation. There are two engine options available for the Acadia: a turbocharged V-4 that produces 228 horsepower and a V-6 that produces 310 horsepower.

A DEPRECIATION OF GMC YUKON

According to projections, the GMC Yukon will depreciate 42% after five years and could have a resale value of $38,314.

The GMC Yukon may be a good choice if the Acadia or Enclave are too small for your business needs. In addition to seating seven or eight passengers, the vehicle has a large amount of cargo space. When the rear seats are folded down, the Yukon has 122 cubic feet of space, while the Yukon XL has 144 cubic feet. To move this beast around, two V-8 engines are available, both with 355 horsepower. Additionally, the Yukon has an impressive 8,400-pound towing capacity, which is ideal for hauling trailers.

TRUCKS WEIGHING OVER 6000 lbs.

A DEPRECIATION FOR THE GMC SIERRA

According to projections, the GMC Sierra 1500 will depreciate by 37% after five years and may have a resale value of $28,816 after five years.

With plenty of towing and hauling capabilities, the Sierra 1,500 is the perfect truck for your business. Three cargo beds are available, from an 8-foot monster to a more compact 5 feet 8 inches. Three cab options are available with seating for three to six people. Five engine options are available, with the powerful V-8 engine being the best choice for towing. Sierra 1,500 has a maximum towing capacity of 11,800 pounds. The turbo diesel engine may be the right choice if fuel efficiency is a priority.

GMC's commercial trucks, the Sierra 2,500 and Sierra 3,500, also qualify for the 6,000-pound vehicle deduction.

DUTTON BUICK GMC HAS THE PERFECT VEHICLE FOR YOUR BUSINESS

If you plan to purchase a vehicle for your business and take advantage of the 6,000-pound vehicle deduction, we hope you'll find what you're looking for at our amazing Riverside dealership. You can find a wide variety of great options in our extensive inventory, whether you need a roomy SUV or a powerful truck. For the best deal on your next vehicle, be sure to check out our finance center and incentives pages.

Do not hesitate to contact us if you have any questions about any of the vehicles we have available, or if you'd like to begin the purchasing process.